"It’s hard to invest for the long term when you’re living hand to mouth."

How social investment enabled innovative tech-start up, TellJO, to support thousands more people facing problem debt.

Tell us about your organisation?

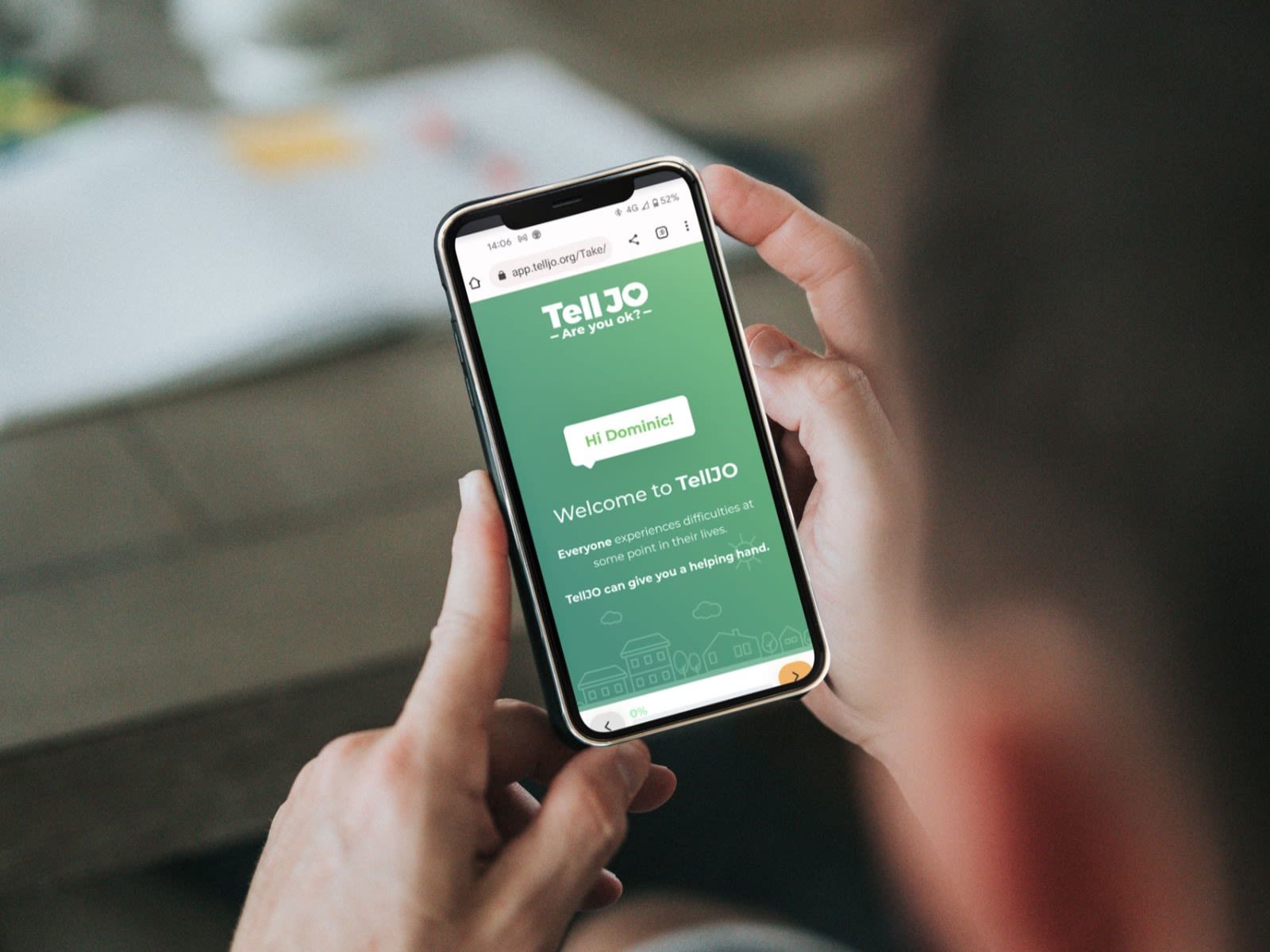

TellJO uses technology to help organisations collect debts in a way that works better – both for the person in arrears and the organisation that’s owed money.

Debt collection conversations have traditionally started off on the wrong foot, by threatening people with consequences. It’s a lazy approach that has never produced very good outcomes for anyone concerned. Instead our platform responds to a trigger, such as a missed payment, by asking people an empathetic question: are you ok?

They’re then invited to complete a web-based wellbeing assessment that delivers better results for everyone: guidance and support for the person in arrears, quicker payment of debts, and a better understanding of customers in debt for the organisations who are owed money.

It’s a win-win-win.

How do you make a difference?

If you’re struggling with your finances – as so many now are – then being sent threatening, impersonal, uncaring letters isn’t going to help.

By taking a more helpful, caring approach, TellJO encourages people to reveal the underlying reasons for their arrears. They can then be offered support, such as debt advice, to resolve their situation and increase their long-term resilience against debt. And because it allows organisations to understand the nature of the customer’s non-payment, it means they can manage ongoing communications in a more tailored, helpful way. For example, they can avoid sending out enforcement agents if they know somebody has suicidal feelings.

Of the people who complete our assessment, 80% accept an offer to pay their arrears. So the immediate outcomes for organisations are better too.

How did social investment help you?

I’m not a big believer in the grant model, which leaves charities needing to source funding every year – or even more frequently. It eats up so much time and energy that could go towards providing services. And it’s hard to invest for the long term when you’re living hand to mouth.

I believe win-wins exist within business, whereby we can create better outcomes for end-users and organisations. Our model delivers value for organisations, so it’s right that they should pay for it. That then gives us a revenue stream, with more potential to scale than if we were grant funded.

But you’ve got to get off the ground first.

"The funding we received from Sumerian has allowed us to invest in our marketing and employ a sales consultant, with the end result that we can now demonstrate what we do in a much clearer way."

And we don't have to start repaying until 2024, once we’re seeing returns on the investment. I’ve not seen anything like that available commercially.

Sumerian Foundation also now contribute at our board meetings and even mentor us too. I’m normally quite dismissive about these things but the relationship has been first class. We can bounce ideas off them and build confidence in the direction we’re taking.

TellJO impact:

- Supported just under 70,000 people to date

- Engaging with customers who miss payments through TellJO is 5x more likely to result in a payment arrangement than a collection SMS

- TellJO is proven to safely reduce bad debt, evictions and enforcement by 33%.

What does the future look like for TellJO?

It’s early days but the marketing work has increased our pipeline and we’re now having more of the right conversations with the right people.

The funding has given us the bandwidth to get our heads up and look to the future with a medium-to-long-term outlook – not just the short term.

We want to change the way organisations operate and are hoping to secure our first big customer soon. A business with 6 million customers would allow us to reach 1 million people a year, and make a meaningful impact on a bigger scale.

bhbikbjhbik

→ Duration: 9 years → Turnover: £146,406 → Interest Rate: N/a → Amount invested: £150,000 (quasi-equity investment with a target return of 1.8) → Date of investment: October 2022 → Product type: Patient and flexible revenue share agreement → Programme: Flexible Finance

To find out more about social investment and how it could support your organisation, visit Good Finance.

To find out more about Access - The Foundation for Social Investment, visit our website.